Since 2020, we are witnessing a significant surge in the cost of transportation of industrial goods and shipping services rates for consumers goods, in many countries and key markets such as Parcels & Trucking services, Ocean containers transportations and air-freight services.

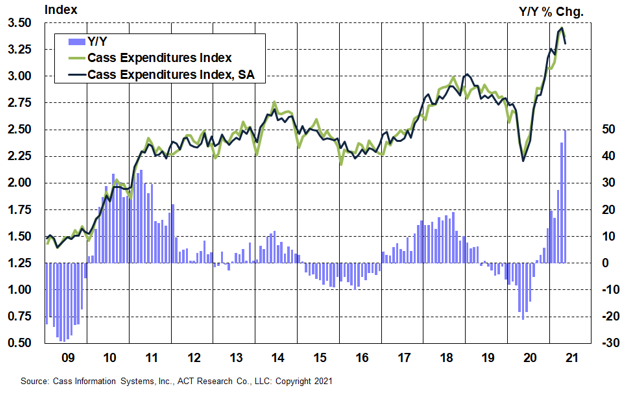

The increase of demand for containers and Sea-freight services has created a significant increase of the Cass Freight Index of Expenditures, in 2021 due to the amount of orders for the shipment of manufactured goods, versus the limited capacity of containers produced available and the global Sea-freight capacity available.

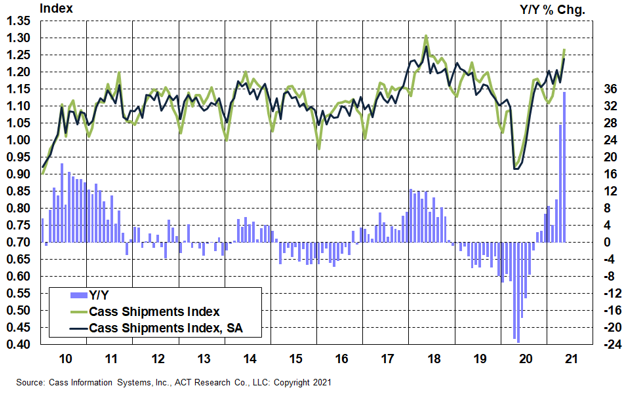

The Shipment Freight Index rose by 36%y/y in May 2021, after a significant increase of 28% y/y in April 2021. It is obvious that the economic recovery was certainly initiated with the announcement of the Financial stimulus of $1,9 Trillion signed up in March 2021 by the American Government.

The Cass Freight Index for Expenditures, rose by 50% y/y in May 2021, after a historical increase of 45% y/y in April 2021. Such levels of expenditures have not been seen during the last decade, and since 2008.

Obviously the significant reduced activities level of 2020, can be linked to the governmental protective measured linked to the COVID-19 pandemic situation. Then the rise of activities is certainly linked to the retails and e-commerce activities around the country.

In addition, all imported industrial goods that supply manufacturers, oil and gas drilling operations, and construction is going wild right now. All these goods have to be transported by sea or by air to meet the growing demand.

The Shanghai Containerized Freight Index (SCFI), which tracks the shipping containers rates from Shanghai on 13 major shipping routes, has nearly tripled from a year ago to a record of almost 3749 this 18th of June.

Such price increase is putting a high pressure on the transportation of manufactured good from China, certainly due to the combination of high demand for goods, shortage of containers and COVID-19 safety measures.

Container rates to the US West Coast, which account for 20% of the SCFI, rose to a new record of $4,054 per FEU (Forty-foot-Equivalent Unit), a standard measuring unit in the shipping industry. Chart of the Shanghai Containerized Freight Index (SCFI)

It is important to point out the need for alternative transportation solutions here due to the increase of e-commerce activities linked to the COVID-19 pandemic situation, forcing some companies to close out due to their low level of cash and the global slow down of activities in 2020.

Many of the goods shipped out in commercial flight have now to be shipped, by using alternative shipping solutions. The air-freight rates are now becoming competitive due to the limited sea-freight capacities now becoming a serious alternative for shipment of cargo.

Another point to make here is the lack of trucks capacities due to the high level of bankruptcies in 2020.

The limited capacities of containers in the hight demand locations such as Shanghai meanwhiles others destinations are trying to get rid of their stocks of containers is opening the opportunity to new location to develop their activities and serve this coming market.